Investment Vs Speculation Vs Gambling Ppt

For either investing or gambling, the beginning of Murkco’s definition is the same: An activity in which money is put at risk for the purpose of making a profit. But while the purpose of gambling and investing is identical, the methods by which the purposes are achieved are. Mar 20, 2012 Investment Vs Speculation Basis Investment Speculation4.Insider trading analysis Not possible Based on insider trading transaction happen5.Stability of Income Very stable Uncertain and erratic6.Sources of income Earning of enterprises Change in market price7.Length of commitment Long run For a short time period PRESENTED BY:ANU MISHRA 8.

- Investment Vs Speculation Vs Gambling Ppt 2016

- Investment And Speculation

- How Is Speculation Like Gambling

- Investment Vs Speculation Vs Gambling Ppt Pdf

- Investment Vs Speculation Vs Gambling Ppt 2017

In financial jargon, the terms investment and speculation are overlapping and used synonymously. In investment, the time horizon is relatively longer, generally spanning at least one year while in speculation, the term may extend up to a half year only.

As per Benjamin Graham, an American economist, and professional investor, investment is an activity, which upon complete analysis assures the safety of the amount invested and adequate return. Conversely, speculation is an activity which does not satisfy these requirements.

The basic distinguishing point amidst these two is that income in the investment is consistent, but in the case of speculation is inconsistent. So this article makes an attempt to clear the differences between investment and speculation. Have a look.

Investment Vs Speculation Vs Gambling Ppt 2016

Content: Investment Vs Speculation

Comparison Chart

| Basis for Comparison | Investment | Speculation |

|---|---|---|

| Meaning | The purchase of an asset with the hope of getting returns is called investment. | Speculation is an act of conducting a risky financial transaction, in the hope of substantial profit. |

| Basis for decision | Fundamental factors, i.e. performance of the company. | Hearsay, technical charts and market psychology. |

| Time horizon | Longer term | Short term |

| Risk involved | Moderate risk | High risk |

| Intent to profit | Changes in value | Changes in prices |

| Expected rate of return | Modest rate of return | High rate of return |

| Funds | An investor uses his own funds. | A speculator uses borrowed funds. |

| Income | Stable | Uncertain and Erratic |

| Behavior of participants | Conservative and Cautious | Daring and Careless |

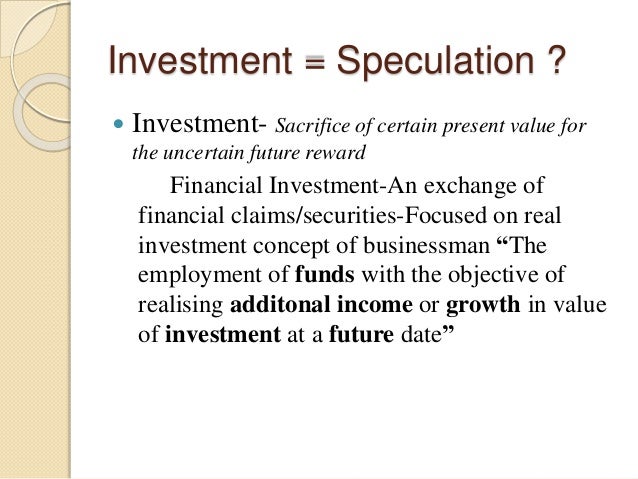

Definition of Investment

Investment refers to the acquisition of the asset, in the expectation of generating income. In a wider sense, it refers to the sacrifice of present money or other resources for the benefits that will arise in future. The two main element of investment is time and risk

Nowadays, there is a range of investment options available in the market as you can deposit money in the bank account, or you can acquire property, or purchase shares of the company, or invest your money in government bonds or contribute in the funds like EPF or PPF.

Investments are majorly divided into two categories i.e. fixed income investment and variable income investment. In fixed income investment there is a pre-specified rate of return like bonds, preference shares, provident fund and fixed deposits while in variable income investment, the return is not fixed like equity shares or property.

Definition of Speculation

Speculation is a trading activity that involves engaging in a risky financial transaction, in expectation of making enormous profits, from fluctuations in the market value of financial assets. In speculation, there is a high risk of losing maximum or all initial outlay, but it is offset by the probability of significant profit. Although, the risk is taken by speculators is properly analysed and calculated.

Speculation ca be seen in markets where the high fluctuations in the price of securities such as the market for stocks, bonds, derivatives, currency, commodity futures, etc.

Key Differences Between Investment and Speculation

Investment And Speculation

The basic difference between investment and speculation are mentioned in the points given below:

- Investment refers to the purchase of an asset with the hope of getting returns. The term speculation denotes an act of conducting a risky financial transaction, in the hope of substantial profit.

- In investment, the decisions are taken on the basis of fundamental analysis, i.e. performance of the company. On the other hand, in speculation decisions are based on hearsay, technical charts, and market psychology.

- Investments are held for at least one year. Hence, it has a longer time horizon than speculation, where speculators hold assets for short term only.

- The quantity of risk is moderate in investment and high in case of speculation.

- The investors, expect profit from the change in the value of the asset. As opposed to speculators who expect profit from the change in the prices, due to demand and supply forces.

- An investor expects the modest rate of return on the investment. On the contrary, a speculator expects higher profits from the speculation in exchange for the risk borne by him.

- The investor uses his own funds for investment purposes. Conversely, speculator uses borrowed capital for speculation.

- In speculation, the stability of income is absent it is uncertain and erratic which is not in the case of investment.

- The psychological attitude of investors is conservative and cautious. In contrast, speculators are daring and careless.

Conclusion

At the end of this discussion, it can be said that both are different and should not be used interchangeably. Investors play a very crucial role in maintaining liquidity in the market but speculators too, play a major character in absorbing excessive risk and providing required liquidity, at the time when investors do not participate.

How Is Speculation Like Gambling

Related Differences

Investment Vs Speculation Vs Gambling Ppt Pdf